Long-term disability insurance serves as a financial lifeline, providing a critical safety net when individuals are unable to work due to debilitating illnesses or injuries. Understanding the pricing of long-term disability insurance is essential for making informed decisions about coverage. In this article, we’ll explore the pricing structure, how costs are calculated, and the typical benefits provided by long-term disability insurance plans.

Can You Explain the Pricing Structure for Long-Term Disability Insurance?

The cost of long-term disability insurance is influenced by a combination of factors. To comprehend the pricing structure, let’s delve into these key elements:

Age: Age is a primary determinant of premium costs. Younger individuals typically pay lower premiums because they statistically have a lower risk of experiencing a disability. As you grow older, premiums tend to rise.

Occupation: Your occupation significantly impacts pricing. High-risk professions, such as construction workers or firefighters, often have higher premiums due to the increased likelihood of disability.

Health Status: Your current health and medical history are crucial factors. Pre-existing health conditions or a history of disabilities may result in higher premiums.

Benefit Amount: The monthly benefit amount you select directly affects the premium. Higher benefit amounts lead to higher premiums. It’s vital to strike a balance between affordable premiums and adequate coverage.

Benefit Duration: The length of time for which benefits are paid impacts pricing. Longer benefit durations result in higher premiums, providing coverage for an extended period.

Riders and Customization: Some policies offer additional riders or customization options, such as inflation protection or cost-of-living adjustments. These features can increase premiums but provide enhanced protection.

Insurance Provider: Different insurance companies may have varying pricing structures and underwriting criteria. Comparing quotes from multiple providers can help find the best-priced policy for your needs.

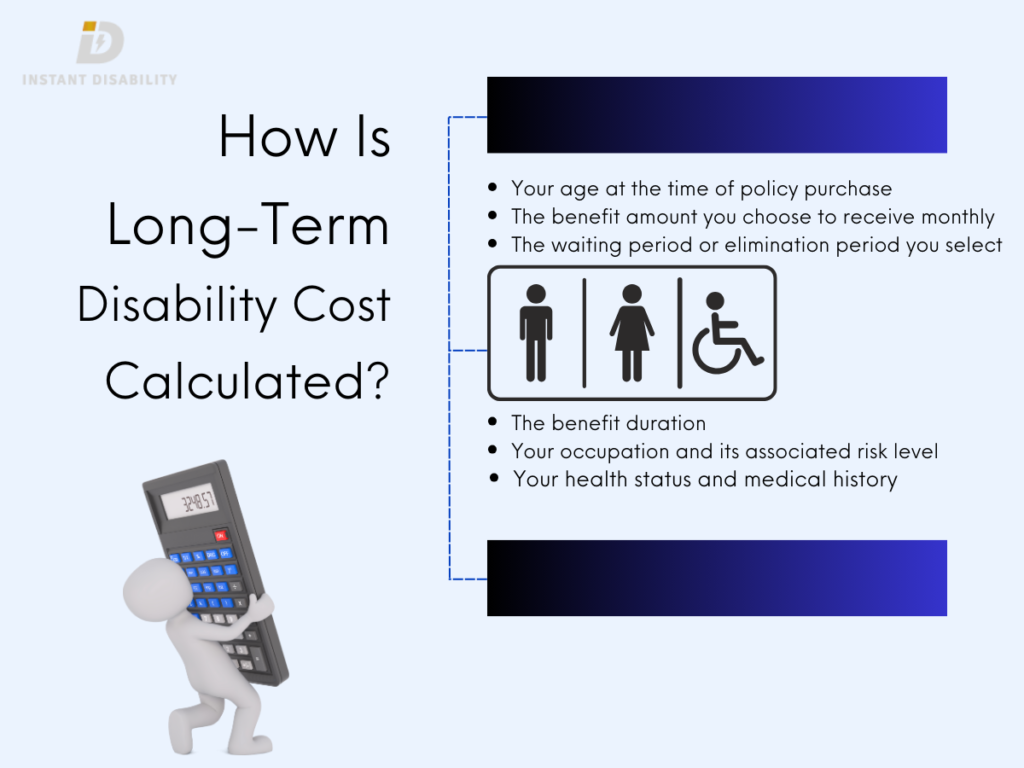

How Is Long-Term Disability Cost Calculated?

Long-term disability insurance premiums are calculated using a mathematical formula based on the factors mentioned above. Generally, the calculation considers the following elements:

- Your age at the time of policy purchase.

- The benefit amount you choose to receive monthly in case of disability.

- The waiting period or elimination period you select.

- The benefit duration, which specifies how long benefits will be paid if you become disabled.

- Your occupation and its associated risk level.

- Your health status and medical history.

Any additional riders or customization options you include in your policy. Insurance providers use these variables to assess the likelihood of you making a claim and determine the associated risk. Consequently, the premium is set accordingly to cover these potential claims while ensuring the insurer’s profitability.

How Much Do Most Long-Term Disability Insurance Plans Pay?

The amount paid by long-term disability insurance plans varies depending on the terms of the policy. However, most plans aim to replace a percentage of your pre-disability income. Commonly, long-term disability insurance plans pay between 50% and 70% of your pre-disability income. This percentage is specified in your policy and can be adjusted based on your needs and budget.

It’s important to review the policy carefully to understand the exact terms, including the percentage of income replacement and any limitations or exclusions. Keep in mind that higher benefit percentages often result in higher premium costs.

Final Words

Understanding the pricing structure and cost calculation of long-term disability insurance is vital for making informed choices about coverage. By considering factors like age, occupation, health, benefit amount, waiting period, and more, you can tailor your policy to meet your unique needs while balancing affordability. Most long-term disability insurance plans aim to replace a portion of your income, typically ranging from 50% to 70%. Evaluating your options and comparing quotes from multiple providers can help you secure the right coverage to safeguard your financial well-being in case of disability.